Monthly Archives: October 2015

Central States Pension Fund Prepares To Slash Hundreds of Thousands of Workers’ Pensions

(Jagz Mario / Flickr)

For several months, many current and retired truck drivers have feared receiving a letter in the mail that could be “devastating,” in the words of Teamsters union vice-president John Murphy. Finally, last Friday, the Central States Pension Fund sent those dreaded letters to 407,000 workers and retirees, mainly Teamsters employed by hundreds of trucking-related companies with roots in the Midwest, South and East.

Each individualized letter told them in detail whether the fund will now cut their promised pension payments—and, if so, by how much.

Four decades after Congress first passed legislation protecting workers against such cuts, these reductions in promised benefits derived from workers’ deferred wages have started again, thanks to legislation passed late in 2014 with support from not only many businesses but also some unions and traditionally pro-union members of Congress.

Pro-worker advocates like the Pension Rights Center warn that this move to cut the benefits at the troubled Central States Pension fund could spread to other, more securely financed multi-employer plans as well as even more widespread single-employer, defined-benefit plans. But it could also spur support for legislation introduced in June by Sen. Bernie Sanders (I-VT) and Rep Marcy Kaptur (D-OH) that would save the endangered pensions.

The cuts in monthly payments to workers covered by Central States will vary from nothing (for about one-third of the group) to more than 60 percent (the highest losses will be suffered by many in a group of about 28,400 Teamsters whose employers had abandoned their employees, usually via bankruptcy and closure). The average loss for all participants will be 22.6 percent of retirement pay on which they had counted, according to the summary prepared by the fund trustees.

The hardest hit appear to be workers who have less than 20 years employment under the Central States fund, are not yet retired, or left their Central States employer (by quitting or being terminated).

For example, after 12 years under the Central States fund, Jeff Dexter, 49, left his job about 11 years ago to work at a non-profit organization. Over the weekend, he got his letter telling him that when he retires after 2031, he was eligible for a pension of $476.82 a month, not the $1,558.06 he would have received. He calculated the cut: 69.4 percent.

He thought about his wife and the small size of spousal benefit she might get—a worry he says he feels acutely because so many men in his family died young. Then he thought about managers of the fund, especially executive director Thomas Nyhan, who makes $662,060 a year. “It might be okay if he took a 70 percent cut, too,” Dexter muses.

He worries he’ll now have to work into his 80s, he says, but then he thinks of his retired friends now in their 70s and 80s. “I don’t know what they’ll do to support their families,” he said.

Trustees say that the fund is in desperate shape as a result of “trucking industry deregulation, declining union membership and two devastating national recessions.” Deregulation, for example, led to the failure of hundreds of trucking industry firms, both large and small, who left their past employees “orphaned” without anyone to pay into the fund for their retirement (nor pay into the federal government’s pension insurance fund).

Flawed public policy ultimately caused many of the problems leading to the pension cuts, but the price for the rescue of the fund has been privatized and charged to individual workers—but not because of anything they themselves did or did not do.

Local union officials convened on Friday at the Rosemont convention center near Chicago’s main airport on Friday to hear the trustees report on their plan for a “rescue,” but a rescue of the institution, not the workers—much like how after the 2008 financial crisis, there was significant effort to save the banks rather than homeowners threatened with foreclosure. Outside the hall, more than 100 irritated pensioners and their supporters were at the doors, demanding action to protect their retirement security.

Judging from interviews after the closed meeting, many local officials wanted to know why the fund and union leaders had not acted earlier and more forcefully to solve problems and to find alternatives to the hastily passed 2014 Multi-employer Reform Act that had authorized the cuts.

Through the National Coordinating Committee for Multiemployer Plans, a group of employers and some union leaders (composed mainly of building trades unions but also initially Teamsters President James R. Hoffa) included the option of benefit cuts in a report that was the template for the Multiemployer Pension Reform Act of 2014. But the internal backlash from members led Hoffa to switch into opposition, although some members and local officials think he should be more forceful, especially in promoting the Sanders-Kaptur alternative.

Vice-president Murphy told the impatient crowd that president James R. Hoffa could not be there because of a prior personal engagement, but he also praised their work. “There not one person in the House of Representatives or the U.S. Senate that is defending this law,” he told the group, who represented around two dozen statewide committees. “ ‘Oh, we didn’t know what was in the law,’ ” he mockingly scorned their excuses.

Considering that many of the disgruntled present or future retirees on hand were critics of Hoffa, including members of Teamsters for a Democratic Union, the partial convergence of all elements of the union on blocking the cuts was noteworthy.

But many in the crowd thought that Hoffa shares much of the blame. Former president Ron Carey fought a national strike against UPS in 1997 in large part to fight the company’s demand to withdraw from the fund. Ten years later, Hoffa allowed the biggest, healthiest contributor, UPS, to withdraw from the fund, after paying a $6.1 billion withdrawal fee. UPS also agreed to additional contractual protections of UPS workers from any losses at Central States.

“Had they not taken UPS out of the fund we would not need this rescue,” one local union president said, asking not to be named for fear of political attacks. “That started the whole ball rolling. … It’s the number one reason why the fund is in the dumps.”

As a result of the shrinkage of its base, Central States is now paying out $3.46 in benefits for every $1 it takes in, thus paying $2 billion a year more than they receive, an untenable situation that could lead to insolvency within a decade. Since the fund claims now to be earning a return on investment similar to other big multi-employer pension funds, the problem reflects the decline of union members and the accumulation of unfunded obligations, not investment prospects.

But who should pay? The retirement benefits flow from money that members would otherwise have received as income but preferred to take as pension payments to guarantee secure their old age. Cutting their benefits is a cut in pay for a problem not of their own making.

In 1974 Congress passed the Employee Retirement Income Security Act to block employers from such cost-shifting. It established an insurance program under the Pension Benefit Guaranty Corporation (set up under ERISA) that helps workers whose funds have failed up to a point—usually below what they might have otherwise received to restore retirement income. The Central States rescue plan guarantees payments at least 10 percent above the PBGC minimum.

Central States’ action makes “it the first [company] in 40 years to be allowed to cut its benefits,” noted Karen Ferguson, executive director of the Pension Rights Center, which has joined with the Teamsters, Machinists and a few other unions in attacks on the employer move. The Multiemployer Pension Reform Act (MPRA), passed last December without hearings and buried in the Omnibus spending bill, makes that break with the past possible. Co-sponsored by Rep. John Kline (R-OH) and Rep. Marcy Kaptur (D-OH), the legislation sped through Congress with little fanfare (or hearings) pro or con and key support of Rep. George Miller (D-CA), the retiring but still ranking Democrat on the House Education and Workforce Committee.

The letters Teamsters are now receiving reflect a plan that Central States submitted to the Treasury department on Tuesday. MPRA set certain limits: no cuts could be imposed on workers more than 80 years old, and only small concessions could be wrought from those 75 to 80 years old. These age groups include 41 percent of all participants. Also, people with disabilities get more secure protection, and UPS workers have their contractual back-up protection.

But drivers at the “orphans,” especially ones who worked for such companies for many years, will lose deeply, even though they did the same sort of hard work as those still getting full pensions.

“The whole thing is a rotten deal,” Ferguson said.

The bill introduced by Sens. Bernie Sanders (I-VT) and Sherrod Brown (D-OH), along with Rep. Marcy Kaptur (D-OH)—Keep Our Pensions Promises Act (KOPPA), would restore the orphans’ pensions. Rather than use general revenue funds, as a failed 2010 legislative proposal would have done, it relies on revenue from the elimination of two specific tax loopholes that largely benefit rich speculators.

Under MPRA, pension fund beneficiaries must vote their approval or disapproval within 30 days, but ballots will be counted as “for” the rescue plan’s cuts if beneficiaries do not return their ballots. Also, the Treasury can override any vote if it wants, and workers are blocked from suing the Fund. Sen. Rob Portman (R-OH) is planning to introduce legislation early in October to change the voting procedure to make it less of an obstacle to democratic decision-making.

It is especially urgent to make such a democratic change, not only to guarantee a truly representative vote on such an important issue, but also to recognize the he slow but significant progress of democratic reform in the union.

“If we didn’t have democracy in the Teamsters as there is now, would we have had this, these Jimmy-Come-Lately efforts to stop the damage?” asked Dan Campbell, a retired Teamster worker, elected officer and staff member who has supported TDU but says he’s happy to have help from Hoffa and anyone else. “If it weren’t for [union leadership] elections coming up next year, the answer is, no.”

Democracy still offers some hope for workers to have a voice on the pension that they not only were promised but had earned. It means something to Jeff Dexter. “At first I was stunned,” he said about the pension news, “then I was saddened. Now I’m pissed off. I truly believe this could have been avoided.”

DAVID MOBERG

David Moberg, a senior editor of In These Times, has been on the staff of the magazine since it began publishing in 1976. Before joining In These Times, he completed his work for a Ph.D. in anthropology at the University of Chicago and worked for Newsweek. He has received fellowships from the John D. and Catherine T. MacArthur Foundation and the Nation Institute for research on the new global economy. He can be reached at davidmoberg@inthesetimes.com.

Planned pension cuts outrage retired Teamsters

More than 150 retired Teamsters rallied at the union’s Downtown offices on Thursday afternoon to voice their outrage over possible cuts to their pensions by the Central States Pension Fund.

“They must think we’re stupid,” said J.R. Carroll of Columbus. “I thought they worked for us. It’s going to devastate our lives.”

The meeting was held after the Central States Pension Fund told retirees that it is wrapping up work on what it calls a “necessary and fair pension rescue plan,” which it will file with the federal government.

The cuts that were outlined in a letter sent to him, Carroll said, would mean that his pension would be reduced from $2,800 a month to $600.

“This is not the union I became part of in the ’70s,” Carroll said.

While Central States sent letters to Teamsters recently that outlined possible cuts, the final proposal has yet to be presented to members. Central States likely will post the plan on its website next week, said Whitley Wyatt of Washington Court House, a spokesman for the Central Ohio Committee to Protect Pensions.

The fund’s action comes after Congress passed a law last year that allows “multiemployer pension plans” such as Central States to reduce benefits to shore up sagging finances.

The Central States fund has said it is spending more money than it is taking in and that it needs to cut benefits to keep the fund solvent.

“The longer we delay, the bigger the benefit reductions will need to be to save the fund,” the fund said on its website. “If we wait too long, even a rescue plan with benefit reductions won’t work, and the fund will run out of money to pay any benefits.”

But Teamsters at the rally were indignant about the cuts and about Central States’ handling of their pensions, especially after one Teamster read a short list that gave details of Central States officials’ annual pay — all making $100,000 or more.

“We worked for these pensions,” said Robert Mitchell of Columbus. “Our contracts guaranteed us what we have today. I say, run it at full speed … and then see if it goes out (of money). If it goes out, the Central States people go out with it.”

“I see nothing whatsoever in this proposal that would make it (the fund) solvent,” said Mike Walden, chairman of the Northeast Ohio Committee to Protect Pensions. “My thought is these cuts are just to keep their (Central States) jobs.

“My opinion is, you should take your chances,” Walden said. “I would definitely like to see an investigation on Central States.”

Any cut would have to be voted on by the retirees and active workers, but the way the law was drafted makes it difficult to block the reduction, opponents say, because the Treasury Department will have the final say on changes to the pension fund.

That means retirees need to bombard Congress with their objections to the cuts, the Teamsters said.

“The only people who can change this law are your House and Senate members,” Walden said.

Meanwhile, new legislation has been introduced that would provide the pension fund with financial support through new taxes on high-wealth individuals, including one bill sponsored by Sen. Rob Portman, R-Ohio.

Portman introduced the proposal after the earlier law, allowing for the pension cuts, was passed in “kind of the dark of the night,” said Stephen White, Portman’s general counsel.

The new proposal would make participant votes binding, White said. It also would count only ballots that are returned.

“It’s going to be an uphill battle,” Wyatt said. “There are 48,000 (retired) Teamsters in Ohio, and we swing a lot of weight, but we have to make our feelings known. We’ve got to get people to hear us.”

Columbus Dispatch

A lump of coal

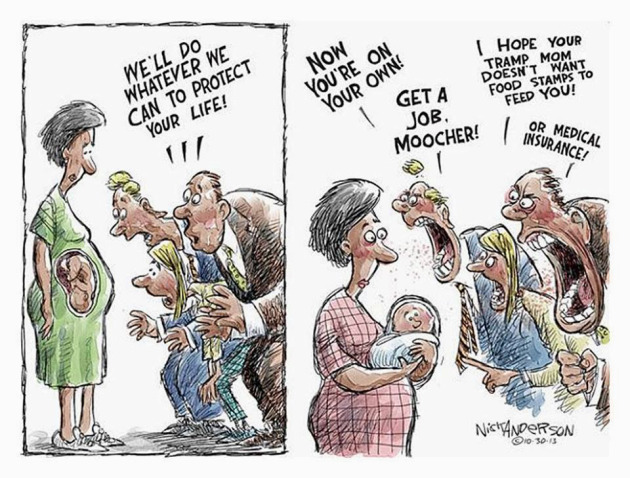

Pro fetus, not pro life

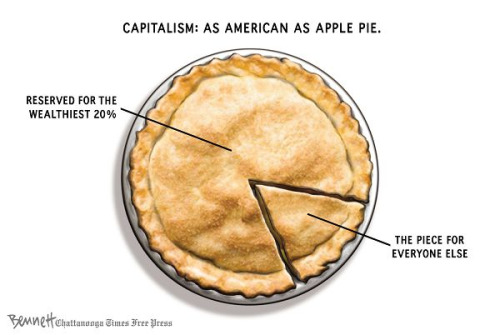

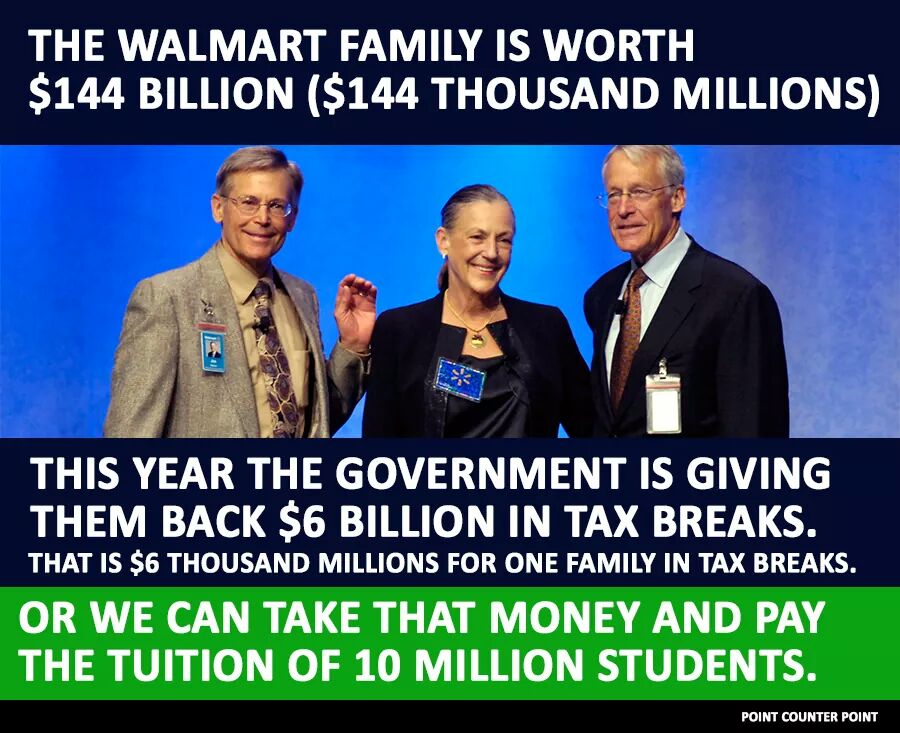

The game is rigged

Common Sense

I think everybody is in agreement that we are a great entrepreneurial nation. We have got to encourage that. Of course, we have to support small and medium-sized businesses.

But you can have all of the growth that you want and it doesn’t mean anything if all of the new income and wealth is going to the top 1 percent. So what we need to do is support small and medium-sized businesses, the backbone of our economy, but we have to make sure that every family in this country gets a fair shake.

Presidential Material?

Act Now

|